Table of Contents

- Tax Planning is for Individuals also…not just for business

- Australia’s tax rates: Top earners shoulder more of the tax burden

- Australia's Average Tax Rate Increase Leads OECD Countries Due to ...

- Latest estimates and trends | Australian Taxation Office

- Tax Brackets Australia 2023, Tax Rates List - urbanaffairskerala.org

- Stage three tax cuts: Bracket creep will put 1m Aussies into top tax ...

- Average Australian slugged ,890 in income taxes last financial year ...

- Household Income Australia Tax - Spot Walls

- Australian Tax Brackets in 2024 - Tax Basics for Beginners - YouTube

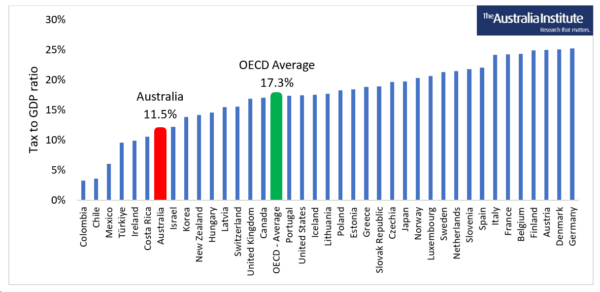

- New research: Australia’s income tax ‘obsession’ debunked | The ...

What are the New Tax Brackets for 2025?

How will the New Tax Brackets Affect You?

Tax Implications for Businesses

The new tax brackets will also have implications for businesses, particularly those with employees. Employers will need to adjust their payroll systems to reflect the updated tax rates, ensuring that their employees' tax deductions are accurate. Additionally, businesses may need to reassess their tax strategies, considering the changes to the tax brackets. This could involve reviewing their income structures, expenses, and tax deductions to minimize their tax liability. The new tax brackets for 2025 are set to bring significant changes to Australia's tax landscape. Understanding these changes is crucial for individuals, families, and businesses to navigate the updated tax system effectively. By being aware of the new tax brackets and their implications, Australians can make informed decisions about their finances and plan for the upcoming financial year. As the 2024-2025 income year approaches, it's essential to stay up-to-date with the latest tax developments and seek professional advice if needed. By doing so, you can ensure that you're taking advantage of the available tax relief and minimizing your tax liability.For more information on the new tax brackets and how they may affect you, visit the Australian Taxation Office website or consult with a tax professional.

Note: The information provided in this article is general in nature and should not be considered as tax advice. It's always recommended to consult with a tax professional or financial advisor for personalized advice.